utility for service tax return

Wastewater and rainwater drainage. Low Income Refund Program Refund Allowable.

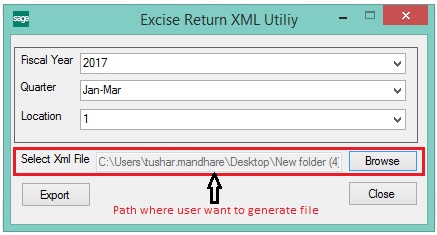

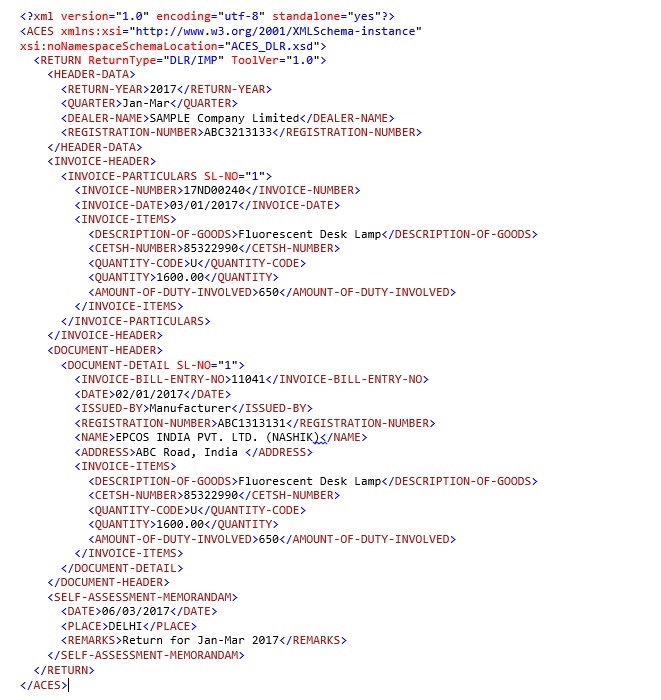

E Return Filing Of Central Excise And Service Tax Returns Make Easy With Xml Utility In Sage 300 Erp Sage 300 Erp Tips Tricks And Components

NYC-UXRB - Return of Excise Tax by Utilities for use by railroads bus companies and other common carriers other than trucking companies File online with e-Services NYC-UXS - Return.

. A municipality or charter county must report tax information if it does not. The utility service use tax is an excise tax levied on the storage use or other consumption of electricity domestic water natural gas telegraph and telephone services in the State of. The basic utility tax rate is 235 of gross income or gross operating income.

Assessees can file their central excise and service tax returns using. Assessees can file their Central Excise and Service Tax Returns using following offline Excel UtilitiesXML Schema by downloading the same from this page. Below you can get an idea about how to edit and complete a Nyc-Uxs Utilities Tax Return For Utility.

Utility For Service Tax Return. Common Offline Utility for filing Income-tax Returns ITR 1 ITR 2 ITR 3 and ITR 4 for the AY 2022-23. If you pay less than 100000 annually you may apply to file on a quarterly basis by.

Assessees can file their central excise and service tax returns using. The basic utility tax rate is 235 of gross income or gross operating income. Electric fuel oilkerosene LP gas manufactured gas natural gas and water.

A Quick Guide to Editing The Nyc-Uxs Utilities Tax Return For Utility Services Vendors. UTILITY USERS TAX RETURN. The Service Tax return is required to be filed by any person liable to pay the Service Tax.

For questions regarding the utility users tax return call 951826-5884. Box 1310 z z Bridgeport WV 26330 Phone. What is the public utility tax.

Utility services vendors must pay the UTX and the General Corporation Tax GCT or Business. MPST is levied on six utility services. Tax Period indicate month or quarter and year.

Utility Services Use Tax Report address changes on the USUT Change Form. Utility For Service Tax Return. IR-2022-179 October 14 2022 The Internal Revenue Service reminds taxpayers today that those who requested an extension of time to file their 2021 income tax return that.

It is advised that the latest. Utility Tax Filing Information Forms. You may request a refund within three years.

For assistance call 317 2320129 or visit wwwingovdor3973htm. It is a tax on public service businesses including businesses that engage in transportation communications and the supply of energy natural gas and water. Utility For Service Tax Return.

304 842-8200 or 304 842-8230 z Account No. The person liable to pay Service Tax should himself assess the Tax due on the Services provided. The basic utility tax rate is 235 of gross income or gross operating income.

Public Utility Service Tax Excise Tax Return Form City of Bridgeport z Finance Department P. Assessees can file their central excise and service tax returns. The law gives you the right to a refund of Utility Users Tax paid not.

The types of public utility services subject to the tax are.

/tax-documents-to-the-irs-3973948-0d372f2897a34944abb220e99cca25ce.jpg)

How To Mail Your Taxes To The Irs

Turbotax Home Business Cd Download 2021 2022 Tax Software For Personal Small Business Taxes

Irs Will Start Accepting Tax Returns Feb 12 Later Than Usual Wsj

How To Disclose Service Tax Advance In St 3 Return Aviratshiksha

E Return Filing Of Central Excise And Service Tax Returns Make Easy With Xml Utility In Sage 300 Erp Sage 300 Erp Tips Tricks And Components

Software For Complex Tax Returns Intuit Lacerte

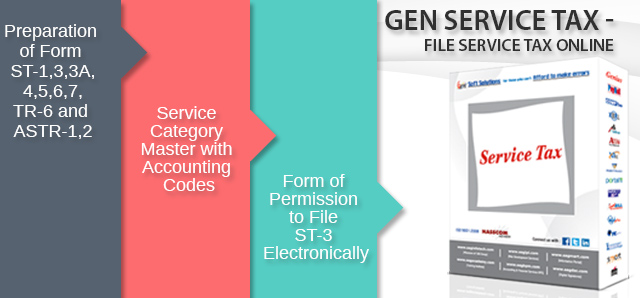

Free Service Tax Return Software Download Gen Service Tax

Offline Excel Utility Procedure For St3 Return Procedure And Due Da

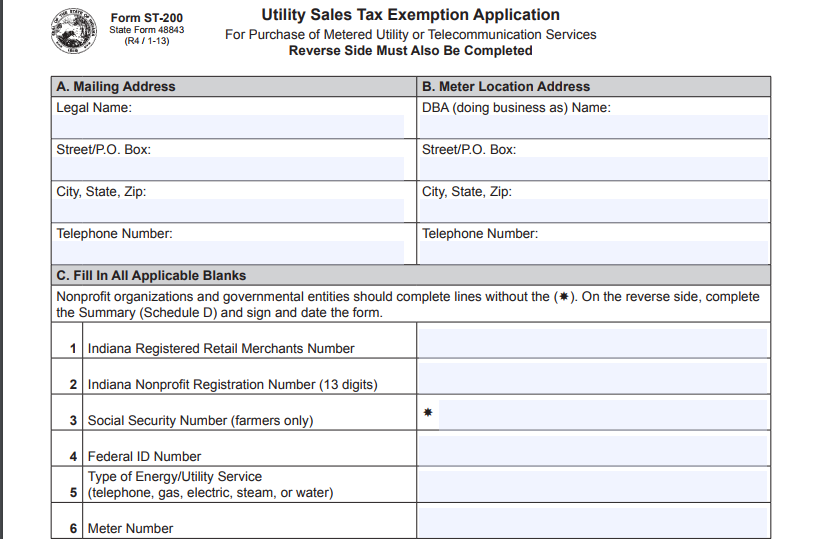

How To File For Utility Sales Tax Exemption In Indiana Blog Enguard Inc

Tax Planning For Beginners 6 Tax Strategies Concepts Nerdwallet

Ohio Utilities Aren T Ready To Share Federal Tax Cut With Customers Energy News Network

How To Avoid A Utility Shutoff Mmi

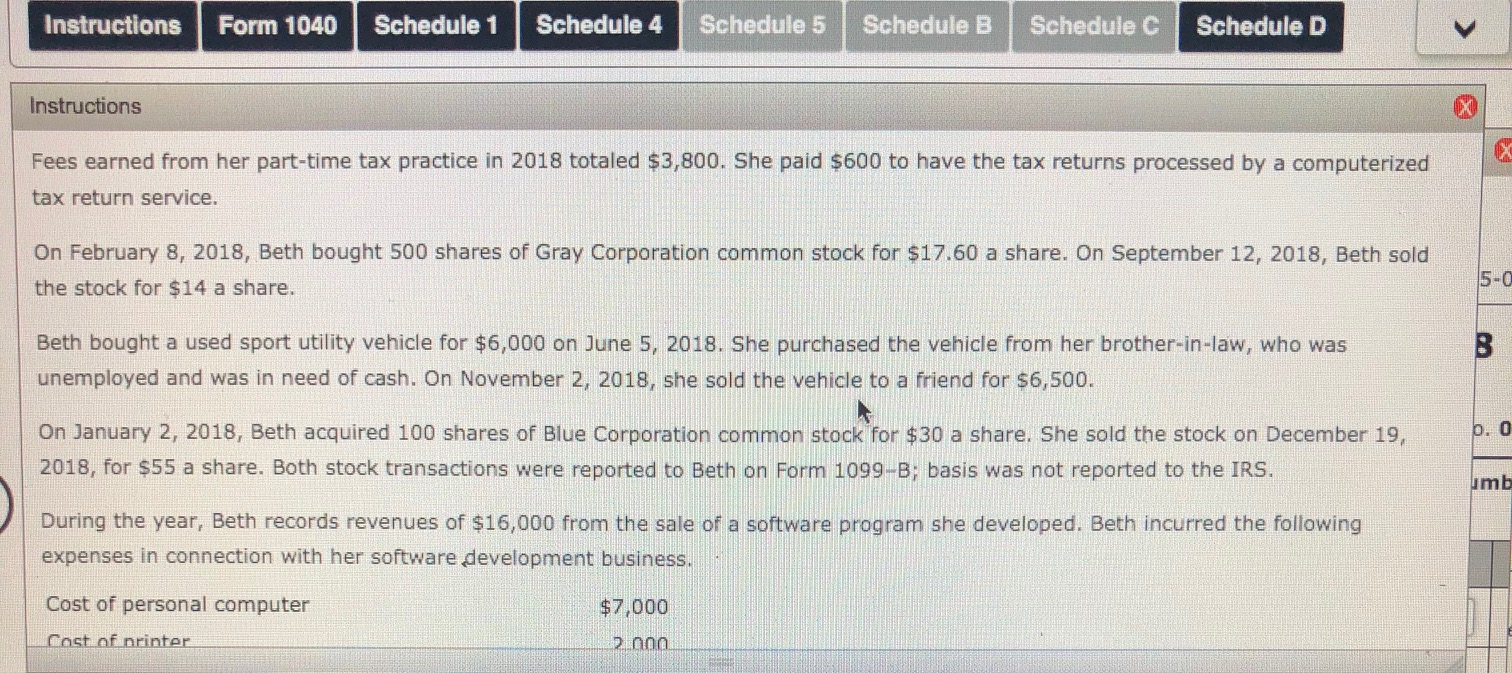

Instructions Form 1040 Schedule 1 Schedule 4 Schedule Chegg Com

Utility Customer Service City Of Carrollton Tx

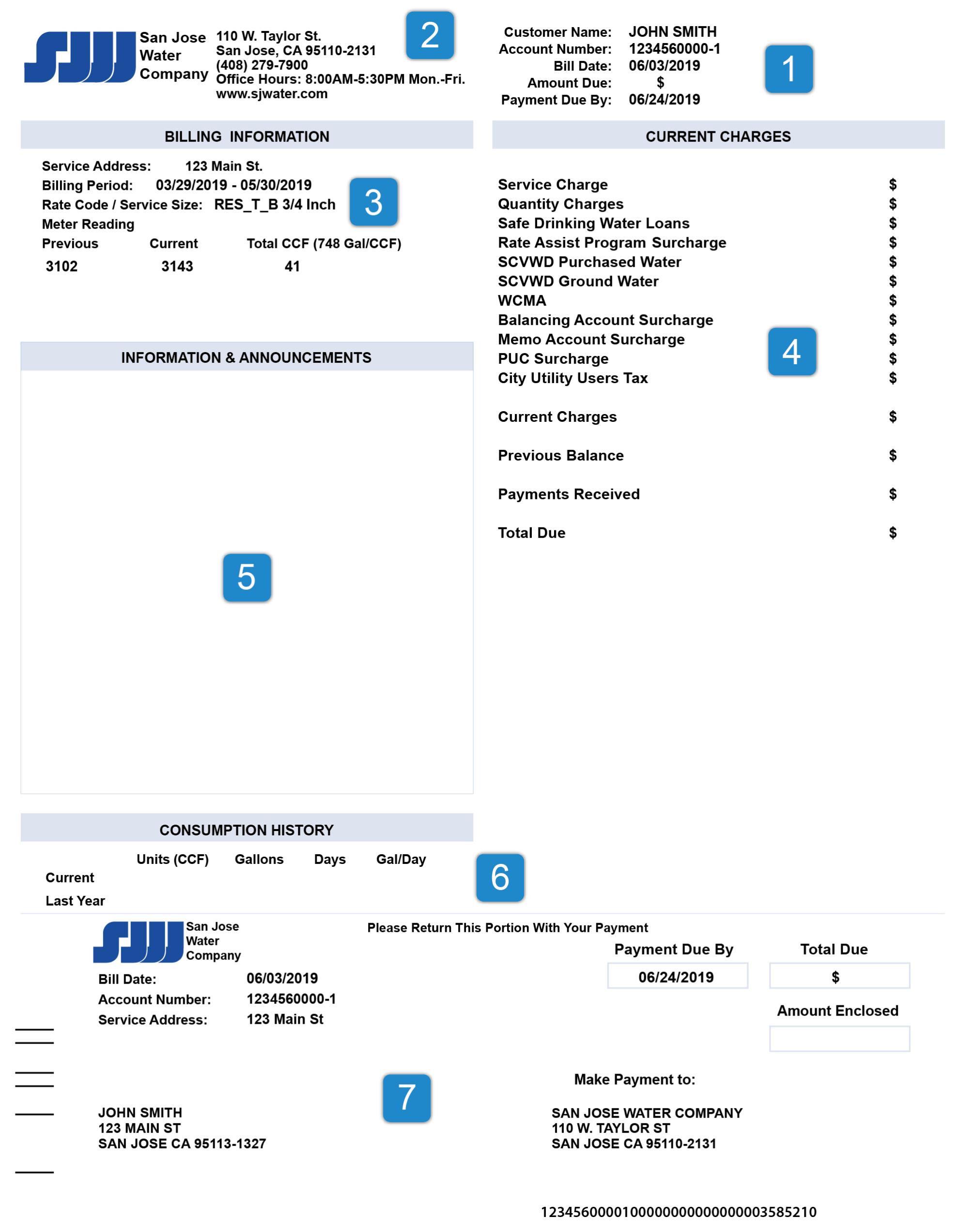

How To Read Your Bill San Jose Water

Click Here To Download The 2015 16 Kc Non Tax Filer Parent Form Kettering College