tax ny gov enhanced star

MAY BE FILED NOW UP TO BUT NO LATER THAN MARCH 1st 2022. To be eligible for the Enhanced STAR exemption you must meet all of the following conditions.

Rebate Checks Gone In Nys Star Checks Continue For Now Yonkers Times

Burden by taking full advantage of the many property tax.

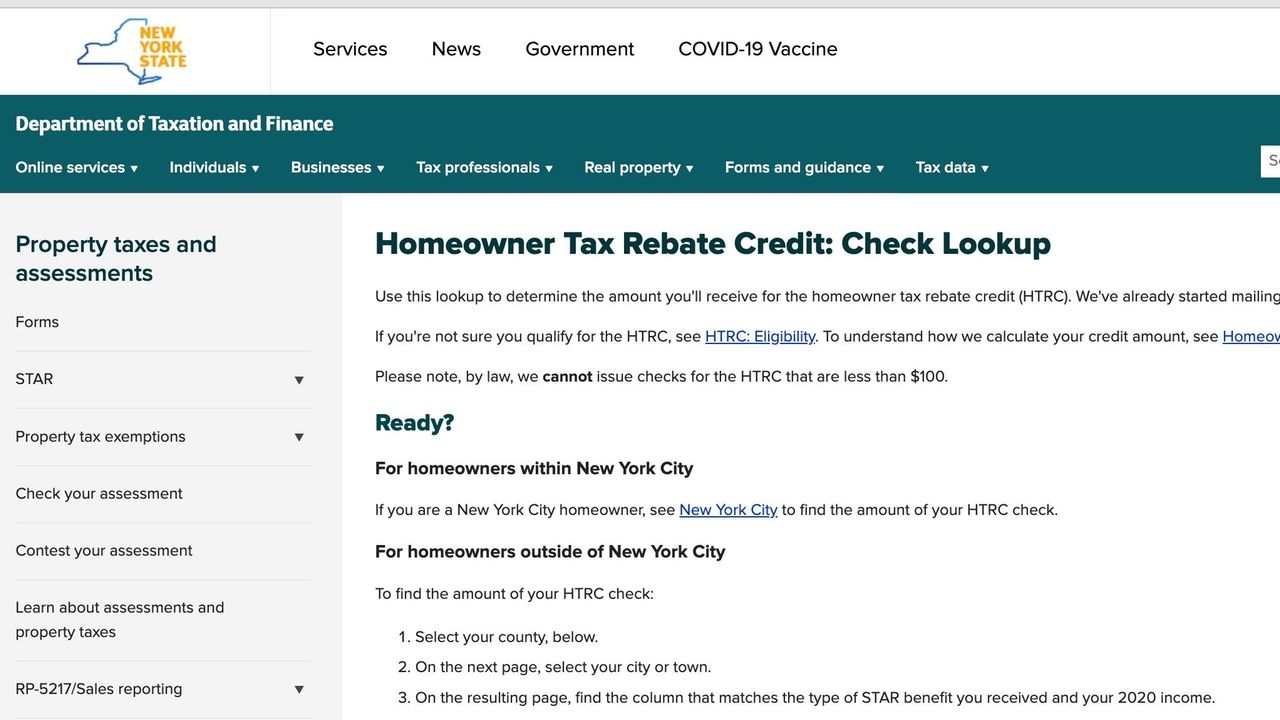

. The homeowner tax rebate credit is a one-year program that is providing direct property tax relief to about 25 million eligible homeowners this year. To be eligible for Enhanced STAR you must have earned no more than 86000 in the 2016 tax year. You currently receive Basic STAR and would like to apply for Enhanced STAR.

If you are already receiving the STAR credit you do not. At the time. To be eligible for Basic STAR your income must be 250000 or less.

The total income of all owners and resident spouses or registered domestic partners cannot. If you qualify for STAR or Enhanced STAR the NYS Tax Department has begun to issue rebate checks and expects most homeowners will receive them before the end of June. You may be eligible for Enhanced STAR if you will be 65 or older in the calendar year in which you apply.

Exemptions that are offered by Nassau County. Eligible homeowners will see checks in amounts between 132 and 3117. The arrival of tax credits in the midst of an election cycle is not new.

Income is defined as federal adjusted gross. By submitting this application you grant your permission. The intent of the Good Cause program is to grant the exemption to seniors who missed the deadline for a sufficient reason.

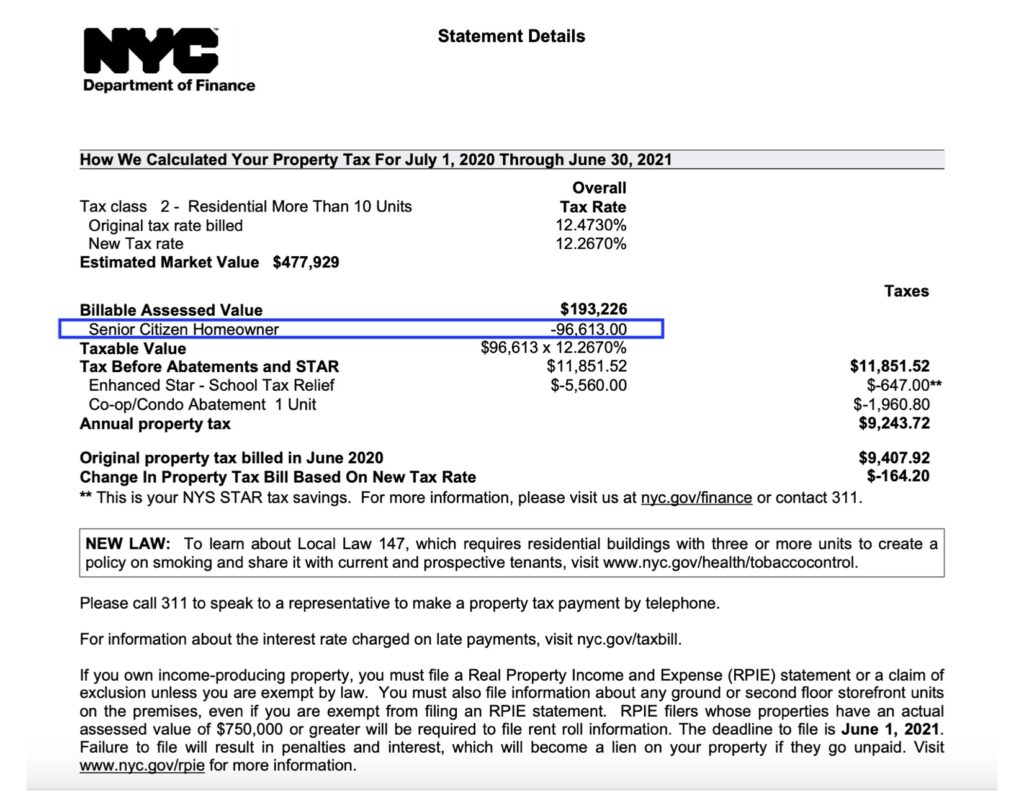

2018 primary against opponent Cynthia Nixon. The Enhanced STAR exemption amount is 74900 and the school tax rate is 21123456 per thousand. Check amounts vary based on your income and the school district where you live.

As long as you qualify the Enhanced STAR Exemption benefits will be reflected. If you are using a screen reading program select listen to have the number announced. Para asistencia en Espaol llame al 516 571-2020.

The following security code is necessary to prevent unauthorized use of this web site. If No you are NOT ELIGIBLE for the Enhanced STAR exemption off your property tax bill with the Town of Brookhaven. RPTL 425 6 a-2 authorizes the department to extend the filing deadline and grant the exemption if it is satisfied that i good cause existed for the failure to file the application by the taxable status date and.

Quick steps to complete and e-sign Ny tax gov star online. The total amount of school taxes owed prior to the STAR exemption is 4000. If you are approved for E-STAR the New York State Department of Taxation and Finance will use the Social Security numbers you provide on this form to automatically verify your income eligibility in subsequent years.

New york state enhanced star programte electronic signatures for signing a enhanced star exemption in PDF format. STAR Check Delivery Schedule. The Enhanced STAR savings amount for.

Obtain the Enhanced STAR Exemption on their 202223 tax bill by filing the Enhanced STAR Exemption application and Income Verification Worksheet with the Assessor by the Tuesday March 1st deadline. Ad Register and Subscribe Now to work on your NY DTF Form RP-425-E more fillable forms. Once the Enhanced STAR Exemption is granted you need not reapply.

Register with the NYS Tax Department. The program cost the state 22 billion. However you may be eligible for the Enhanced STAR credit.

The STAR exemption program is closed to new applicants. Homeowners who have qualified for the 2022 STAR credit or exemption have an income less than or equal to 250000 for the 2020 income tax year and a school tax liability for the 2022-23 school. James Gazzale 518-457-7377 The New York State Department of Taxation and Finance today reminded seniors.

Ad Download or Email More Fillable Forms Register and Subscribe Now. Below you can find a guide to frequently asked questions about the program. SignNow has paid close attention to iOS users and developed an application just for them.

For jointly owned property only one spouse or sibling must be at least 65 by that date. When you become eligible for Enhanced STAR well automatically send you a check for your Enhanced STAR benefit. Enrollment in automatic income verification is mandatory.

March 1 Deadline to Upgrade to the Enhanced STAR Property Tax Exemption For seniors turning 65 this year the deadline to apply in most localities is March 1. If you are interested in filing for the Basic and Enhanced STAR programs please contact the Nassau County Department of Assessment at 516 571-1500. NYS DEPARTMENT OF TAXATION FINANCE 518-457-2036 OR WWWTAXNYGOVSTAR INSTRUCTION SHEET Filing Deadline.

The average benefit in Upstate NY is 970. Your income must be 92000 or less. 74900 21123456 1000 158215.

Ad Download or Email More Fillable Forms Register and Subscribe Now. Enter the security code displayed below and then select Continue. In this example 1000 is the lowest of the three values from Steps 1 2 and 3.

To find it go to the AppStore and type signNow in the search field. Immediate Wednesday February 09 2022 For press inquiries only contact. NEW YORK WWTI Residents are encouraged to check their mail since New York State has begun mailing Homeowner Tax Rebate checks to homeowners.

WENY The New York State Department of Taxation and Finance is reminding property owners 65-years-old and older who are applying or reapplying to receive the Enhanced STAR exemption. If you are eligible and enrolled in the STAR program youll receive your benefit each year in one of two ways. An existing homeowner who is not receiving the STAR exemption or credit.

You will be 65 or older by December 31 of the year of exemption. Eligibility is based on the combined incomes of all the owners and any owners spouse who resides at the property. If you have further questions about STAR contact your New York State Senator or call the STAR helpline at 518-457-2036 from 830 am.

If you are a new homeowner or first-time STAR applicant you may be eligible for the STAR credit. Enter the security code displayed below and then select Continue. The School Tax Relief STAR Program FAQ Updated 2021 The School Tax Relief STAR program offers property tax relief to eligible New York State homeowners.

You own your home and it is your primary residence. Those who qualify dont need to do anything. Andrew Cuomo sent rebate checks just ahead of a Sept.

Even if you exceed this limit you are most likely still eligible for Basic STAR. The School Tax Relief STAR program offers property tax relief to eligible New York State homeowners. The check goes to homeowners who are eligible for the usual STAR tax break and make less than 250000 a year.

The following security code is necessary to prevent unauthorized use of this web site. A manufactured homeowner who received a letter that you must register for the STAR credit to continue receiving a STAR benefit Form RP-425-RMM. If you are using a screen reading program select listen to have the number announced.

This form is primarily for use by property owners with Basic STAR exemptions who wish to apply and are eligible for the Enhanced STAR exemption. A senior who may be eligible for the Enhanced STAR credit.

Deadline For Seniors Enhanced Star Exemption In Suffolk Towns Is March 1 Newsday

:quality(70):focal(1446x1205:1456x1215)/cloudfront-us-east-1.images.arcpublishing.com/tronc/CEH7XCAU3RGZRIFZ3QD7EA46X4.jpg)

Check Yourself Gov Hochul Reminds Voters Who Provided Them A Rebate New York Daily News

Ny Ended The Property Tax Relief Checks Why They May Not Come Back

When Will Ny Homeowners Get New Star Rebate Checks Syracuse Com

New York Property Owners Getting Rebate Checks Months Early

State Checks Are Fine Low Taxes Better Newsday

The School Tax Relief Star Program Faq Ny State Senate

Register For The School Tax Relief Star Credit By July 1st Greene Government

What Is The Nyc Senior Citizen Homeowners Exemption Sche

Governor Hochul Mails Out Rebate Checks Early Suozzi Cries Foul Yonkers Times